Are you tired of the traditional 9-to-5 grind? Dreaming of a lifestyle that allows you to earn money while you sleep? If so, you’ve likely come across the terms “passive income” and “earned income.”

In this blog post, I’ll breakdown and compare passive income vs earned income and dive deep into the differences between the two income streams, exploring their respective advantages and disadvantages to help you paint a clear picture of what you need from each in order to reach your financial goals.

And by the end, you’ll have a clear understanding of how they differ and which one may be the right fit for you.

(You at the end of this article in 2 minutes 👇👇)

Section 1: Passive Income vs Earned Income – Definitions

Passive Income

Passive income refers to the money you earn with minimal effort or ongoing involvement once the initial work has been done. It is often generated through investments, business ventures, or assets that consistently generate income on autopilot.

- Rental Properties

- Dividend Stocks

- Royalties

- Online Businesses

- Affiliate Marketing

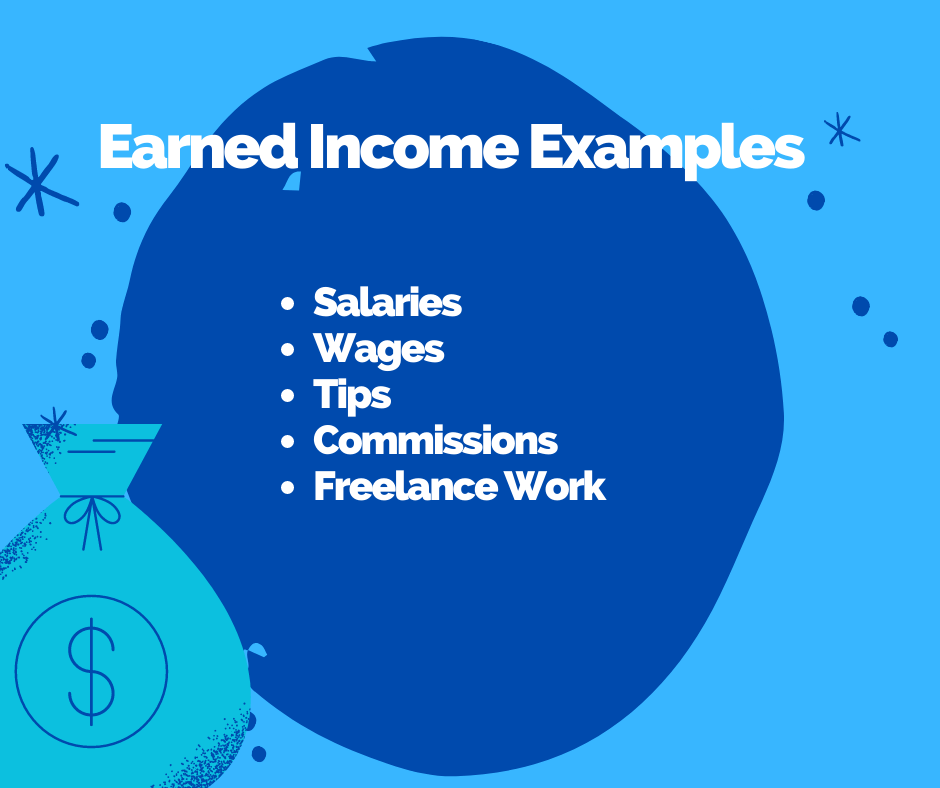

Earned Income:

On the other hand, earned income is money you receive in exchange for the work or services you provide. It is typically tied to a fixed amount of time, skillset, or hourly wage.

Section 2: Passive Income vs Earned Income – What’s the Difference?

Now that we understand the basic definitions, let’s delve into some key differences of passive income vs earned income:

- Time and Effort: Earned income requires active participation, often involving trading time for money. Your income is directly correlated to the hours you work or the projects you complete. In contrast, passive income requires substantial upfront effort but offers the potential for continuous income with minimal ongoing work.

- Control and Flexibility: With earned income, your earning potential is limited by factors such as the number of hours you can work or the rates set by your employer. Passive income provides greater control and flexibility, as you can scale your income by investing in additional assets, optimizing your business processes, or diversifying revenue streams.

- Dependency on Physical Presence: Earned income often necessitates your physical presence to perform the work. You are restricted to a specific location or working environment. In contrast, passive income can be generated from anywhere in the world, allowing you to enjoy a location-independent lifestyle.

- Financial Independence: Passive income has the potential to provide greater financial independence over time. As your passive income streams grow, they can cover your living expenses, allowing you to have more control over your time and pursue other passions. Earned income, on the other hand, may require continuous active work to sustain your lifestyle.

Section 3: Passive Income vs Earned Income – The Benefits of Passive Income

Now that we’ve explored the differences between the two income types, let’s explore some of the benefits of passive income vs earned income:

- Income Diversification: By generating passive income, you can diversify your sources of revenue, reducing your reliance on a single income stream. This diversification can provide stability and help protect you during economic downturns or job losses.

- Time Freedom: Break free from the time-for-money trap. As your income streams grow and diversify, you begin gaining more control over your time and pursue activities that truly matter to you, such as spending time with family, traveling, or working on passion projects.

- Wealth Accumulation: Building multiple streams of income can lead to wealth accumulation over time. As you reinvest your earnings and expand your income-generating assets, you can create a snowball effect, continually growing your wealth without solely relying on your active efforts.

Section 4: Passive Income vs Earned Income – Finding Balance

While passive income offers numerous advantages, it’s essential to strike a balance between the two income sources, especially during the initial stages. A gradual transition allows you to secure a stable revenue while building your money making streams.

Balancing Tips:

- Start Small and Learn: Begin by researching and exploring various opportunities for making money (you can start with our blog post with 15+ Ways to Make Money Online for Beginners) that align with your interests and skills. Start with a manageable investment and gradually expand as you gain knowledge and experience.

- Optimize Your Active Income: While working on building revenue streams, consider optimizing your earned income by acquiring new skills, negotiating higher wages, or seeking additional money sources through freelancing or part-time work.

- Reinvest and Diversify: As your revenue and earnings grow, reinvest a portion of those earnings to expand your income streams or diversify into different asset classes. This approach can help increase your money over time with minimal effort, while also mitigating risks.

Section 5: Final Thoughts on Passive Income vs Earned Income

In a world where the 9-to-5 grind can feel suffocating, the allure of passive income is hard to resist.

By understanding the key differences of passive income vs earned income, you can unlock the door to a lifestyle that offers freedom, flexibility, and financial independence.

While earned income requires your active participation and is limited by time, passive income allows you to break free from the time-for-money trap and create a life where money works for you.

So, whether you’re dreaming of traveling the world, spending more time with loved ones, or pursuing your passions without worrying about finances, exploring passive income vs earned income can help you find the ticket to the life you’ve always wanted.

It won’t happen overnight, but with determination, education, and a willingness to take calculated risks, you can start building revenue streams and take control of your financial future.

Remember, this journey requires patience and a willingness to learn and adapt along the way. Don’t be afraid to start small, explore different opportunities, and gradually transition from relying solely on earned income to incorporating passive income into your life.

Embrace the freedom and potential that passive income offers, and step into a world where your financial destiny is in your own hands.